Fees & policies may vary for customers of IBs. Please contact your broker for more details.

· Broker-assisted trades: +$5 above an electronic commission.

· Commissions does not include exchange & regulatory fees.

Checks: When non-bank checks are received the customer is notified and the funds are generally held in suspense for 5 business days until the account is credited.

Due to current events and intermittent mail service disruptions, please note that check delivery might be subject to delays. Please account for extra time when sending checks to Phillip Capital or requesting check withdrawals.

If you have an introducing broker relationship, the fees assessed may be different from the above since they generally define them. PhillipCapital reserves the right to change the rates at any time.

*PhillipCapital reserves the right to substitute an ACH for a check withdrawal at its discretion (no fee will be assessed).

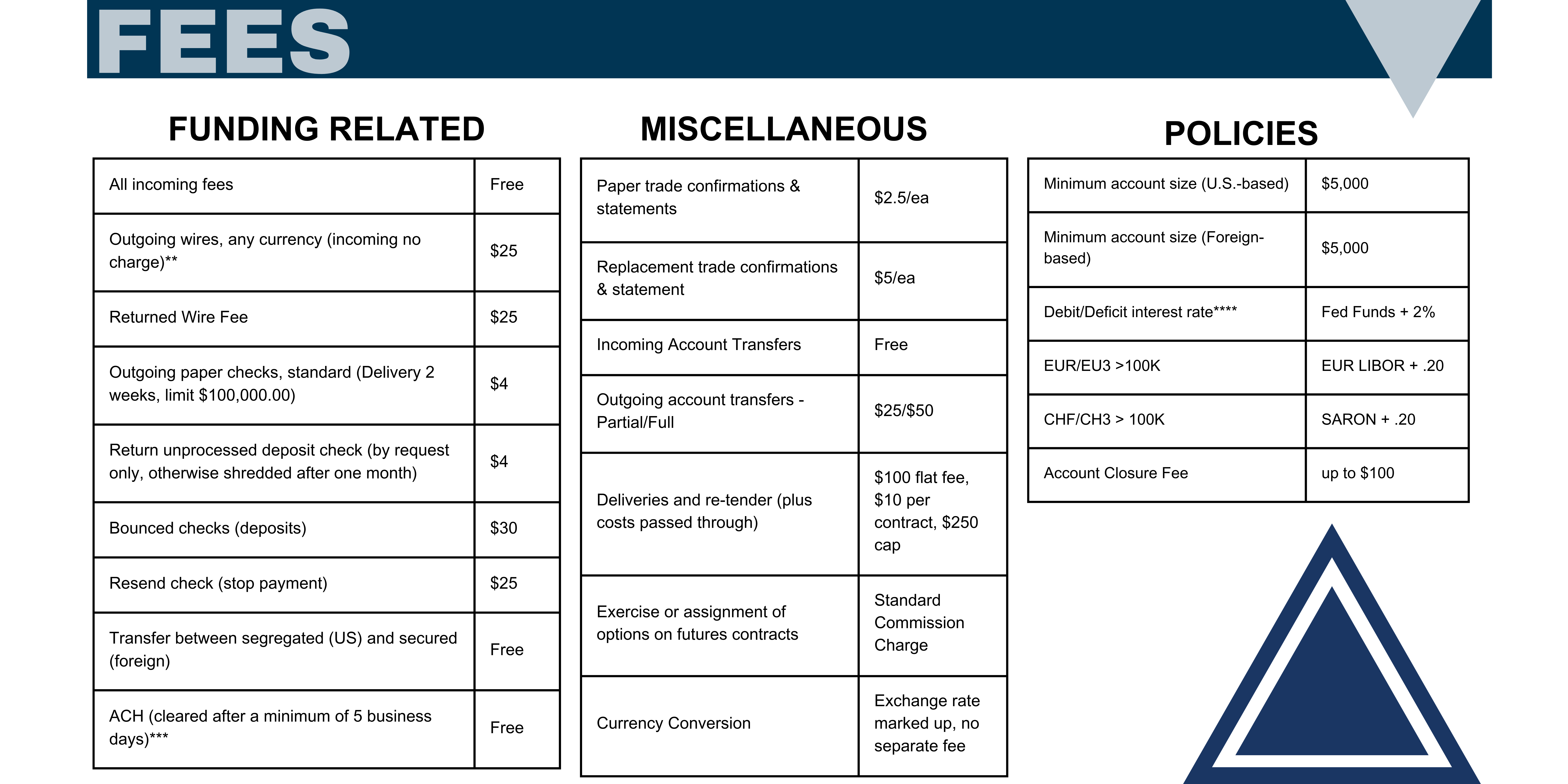

**Bank Details must be on file or payments can be delayed.

***PhillipCapital accrues in interest on a daily basis for each currency and each origin and posts actual interest once a month. Debit interest applies when you have a negative equity and/or margin deficit in a currency and origin; the formula used to calculate debit interest amount is as follows: Debit interest = (equity – IMR) *(debit interest rate/100) * (1/360).